A few weeks ago, I attended a bloggers’ event organised by OCBC Bank at Group Therapy. At the event, we met with OCBC Bank’s e-business team who personally shared with us, OCBC Bank’s revamped online banking initiatives.

After an extensive research with over 900 customers, OCBC Bank revamped and launched its new online banking experience with the objective of simplifying its customers’ online tasks.

The research revealed that banking customers prefer their online experience to be simple and to-the-point. They also want an easy money-management tool which assures them that they’re performing the exact tasks that they would like to. Fair enough, I would agree on these findings as an online banking customer myself.

As such, OCBC Bank’s new online banking is equipped with these features:

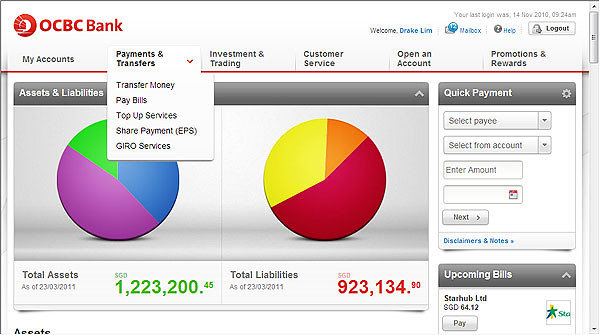

1. Intuitive user interface

– Quick, graphical access to important tasks and information

– Common functions presented upon log in

– Streamlined links

– Logically-ordered, colour-aided navigation

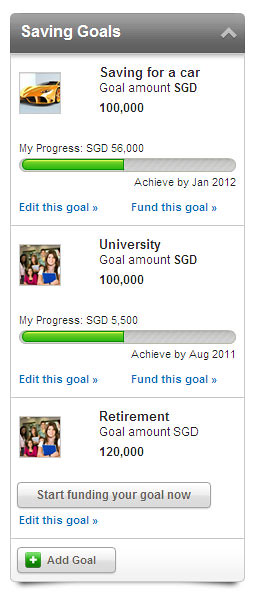

2. Savings jars

– Set savings targets for different purposes and integrate them in one account for better management

3. Online remittances overseas

– Transfer money to banks overseas via the Internet and mobile phone, without the need to visit an OCBC branch

4. Same-day funds transfer

– For a nominal fee, customers can make same-day transfers of funds to other banks in Singapore via the MEPS (MAS Electronic Payment System) network

5. Scan-n-pay using mobile banking

– Scan-n-pay is now available on the iPhone. Scan barcodes on bills and make payments from OCBC Bank accounts

6. Top up Mobile prepaid card

– Customers can instantly top up their mobile prepaid card (from SingTel or StarHub) through online banking and via mobile devices

[youtube url=”http://www.youtube.com/watch?v=yc-0SYZ27OM”]

Impressed?

I was, with OCBC Bank’s simplifying of many banking jargon like “third party fund transfer (who is the second party then?)” to more layman terms like “transfer fund to another account”. The change is so simple and makes so much more sense that you would wonder what took the banks so long to realise this. Complacency? Perhaps big banking institutes were getting too comfortable with making their customer bending over to adapt to their languages and their practices instead of the other way round.

I also like the pie charts that are shown on the OCBC Bank’s online banking personal homepage. These give customers a quick, simple overview of their financial statuses in a jiffy. The customised setting of saving goals was pretty interesting too.

To be honest, I am not an OCBC Bank customer, but I had just opened an account for my baby son with OCBC Bank recently. Hopefully, this will be the start of a fruitful lifelong banking relationship with OCBC Bank, both with Asher and myself. 🙂

About OCBC Bank

OCBC Bank is the longest established Singapore bank, formed in 1932 from the merger of three local banks, the oldest of which was founded in 1912. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s. It is also ranked by Bloomberg Markets as the world’s strongest bank.

For more information, please visit www.ocbc.com or any of the links below:

OCBC Online Banking website

OCBC Online Banking YouTube channel

OCBC Bank Twitter account

Official OCBC Online Banking Twitter Hashtag: #ocbconline

![[PROMO] JomRun brings Crayon Shinchan, Garfield, and Spongebob Squarepants Virtual Fun Runs to Singapore; Register today and enjoy 50% OFF! [PROMO] JomRun brings Crayon Shinchan, Garfield, and Spongebob Squarepants Virtual Fun Runs to Singapore; Register today and enjoy 50% OFF! - Alvinology](https://alvinology.com/wp-content/uploads/2021/09/JomRun-SpongeBob-Event-Cover-8-1-1024x536.png)