In part of their bid to become one of the world’s best digital bank, OCBC Bank recently launched OCBC Money In$ights – a hassle-free online feature that does the hard work of tracking of your everyday expenses and helps you prevent ‘leakage’ of your money.

I met up with the OCBC e-business team behind OCBC Money In$ights a week earlier whereby they shared insights on why they came up with this initiative and how it would benefit their customers.

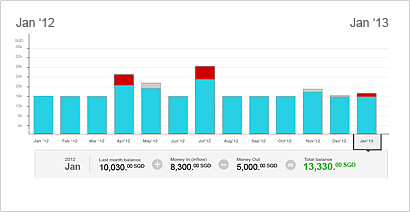

Basically, what Money In$ights does is to automatically categorise your expenses charged to OCBC accounts into several common categories. It also tracks the spending, total balances and money inflows into your OCBC deposit and card accounts for the past 12 months, enabling you to easily monitor your finances.

The simple motivation behind developing this service was really just to help OCBC customers better manage their finances by making it simple and easy to track for everyone.

You can set individual budgets for each category to help you stay on track with your finances. Once you set a budget, OCBC can send you SMS or email alerts when you are about to bust it.

Fundamentally, Money In$ights seek to help save time and effort having to track and enter spending manually into the common standalone personal financial management apps or on spreadsheets.

The best part is that you get to enjoy all these cool features at absolutely no charge! The only obvious catch is that you need to be an OCBC Internet or Mobile Banking customer who charges all your expenses to your OCBC accounts.

If you have multiple bank accounts, the way to work round this is to manually track and merge your expenses with other banks together with your data from Money In$ights.

Some of the key highlights of OCBC Money In$ights:

- Keep track of your spending automatically

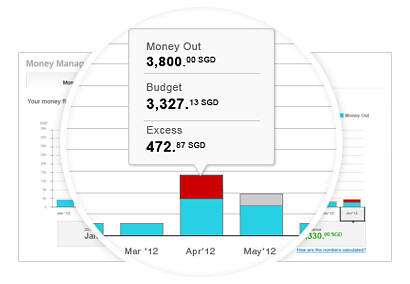

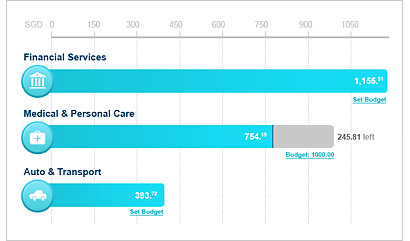

View your spending by month or by expense category in attractive graph charts. You may also reclassify or split expenses into several preset categories such as Dining, Groceries, Insurance and Entertainment.

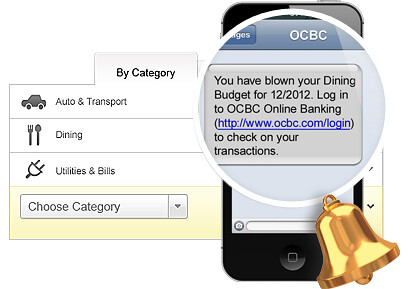

- Set budgets and get alerts through SMS

Keep track of your expenses by setting monthly budgets for specific categories, or as a lump sum. Stay on track with our handy email and SMS reminders that warn you when you are close to exceeding these budgets.

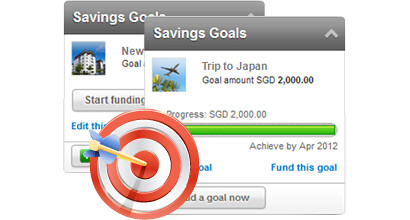

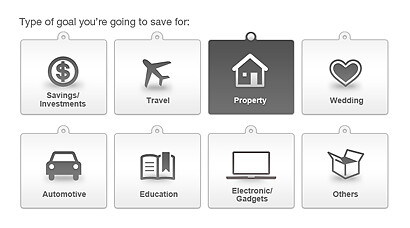

- Set automatic contributions to different Saving Goals within one account

Create different savings goals without having to pay fees or going through the hassle of opening many accounts. Personalise these ‘sub-accounts’ with different names, targets, monthly contribution amounts and durations so you stay on target for your future goals.

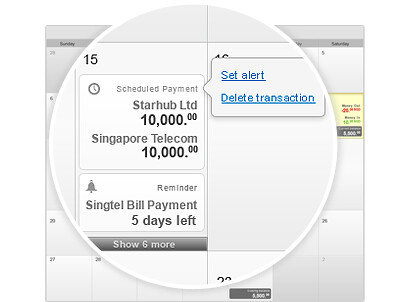

- Manage cash flow with payment reminders

A calendar display gives you bird’s eye view of upcoming payments and your money flows within your account. Easily schedule payment reminders or future bill payments and fund transfers with this feature.

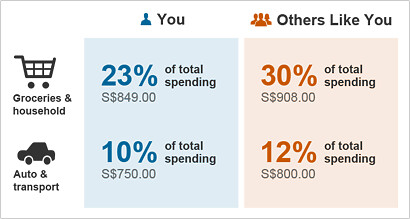

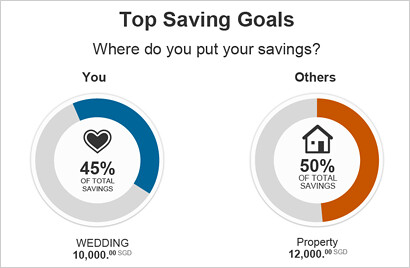

- Get insights on financial behaviour of people with similar demographic profiles

See how you stack up against other people just like you. By comparing demographic criteria such as gender, age range, marital status and location, get insights on the average savings, spending and investment habits of their people just like you.

Impressed?

I find this OCBC Money In$ights pretty interesting and it shows OCBC’s clear resolve to differentiate itself from other consumer banks in Singapore by focusing strongly on user experience for online banking.

When was the last time you stepped into a physical bank and interacted face-to-face with a banking officer?

I think I last did that about three years ago. I went down to get a large casher cheque to pay the downpayment for my first house as it was way over my daily withdrawal and regular cheque limit.

I dislike queuing and waiting. A lot of banking transactions from paying of bills to fund transfer to checking your statement of account can all be done online in the comfort of your own home. Why make an unnecessary trip down to the bank?

I am pretty sure over 90 percent of your interaction with your banks is through their online website. This is how important online banking will be in the future of banking.

OCBC Money In$ights is a pretty simple and easy to use feature. I am not sure of actual usage volume as I am of the impression that most people are too lazy to manage our finance properly. I am guilty of this too. For those who do, it will be very handy! Go try it for yourself.

For me, I see Money In$ights as another step in the right direction from OCBC to stay relevance to changing consumers habits. I look forward to more such innovations and announcements to come from OCBC. 🙂 If you’d like to get more financing tips please make sure to check this recent Money Talks News blog post.

![[Review] Fireplace by Bedrock Launches Unlimited Wood Fired Brunch with Festive Treats at One Holland Village [Review] Fireplace by Bedrock Launches Unlimited Wood Fired Brunch with Festive Treats at One Holland Village - Alvinology](https://media.alvinology.com/uploads/2025/12/firestar-by-bedrock-brunch-grilled-25-110x110.jpg)