Test yourself with this scenario. Which are you going to buy, Property A or Property B? Property A is in Boon Lay, 15 minutes away from the MRT station. Rental yield is at 3%, but it can be difficult to find tenants. It is valuated at $1 million and the seller is asking for $500 million.

Property B is in Toa Payoh, 1 minute away from the MRT station. Rental yield is at 6%, and it’s real easy to get tenants. But here’s the catch: Although it is valuated at $1 million, the seller is asking for $2 million.

Which will you buy, and why?

On the one hand, the Boon Lay property is a great steal, selling at virtually half-price. On the other, you can expect immediate tenancy at the Toa Payoh property, which almost guarantees an annual 6% return on your investment. Weighing the pros and cons in mind, you probably have formed an answer of your own by now. Whatever your decision was – it was formed probably based on certain personal biases.

What if the same scenario were applied to the stock market? Which would you invest in: A penny stock group which has a high net asset value (NAV), low dividend yield and low stock price, or a blue-chip household name which has a high dividend yield but a stock price almost twice that of its NAV?

Is there a way to evaluate value without letting personal biases get in the way?

Yes, there is. Welcome to the Value Investing Mastery Course developed by Alvin Chow and Louis Koay of BigFatPurse. Don’t be mistaken – this is a course about evaluating stocks, not property.

I was invited to sit in one Saturday when the guys were running this course at their cosy office in MacDonald House. Now, here’s where I make an embarrassing admission: I tend to doze off during seminars, speeches, Transformer movies and all manner of classes. But I didn’t feel sleepy at all at this one! I was expecting to be vaguely introduced to their methods, with a sales pitch to attend yet another more expensive course to gain access to their mathematical formulas, but I am happy to report that this is not the case.

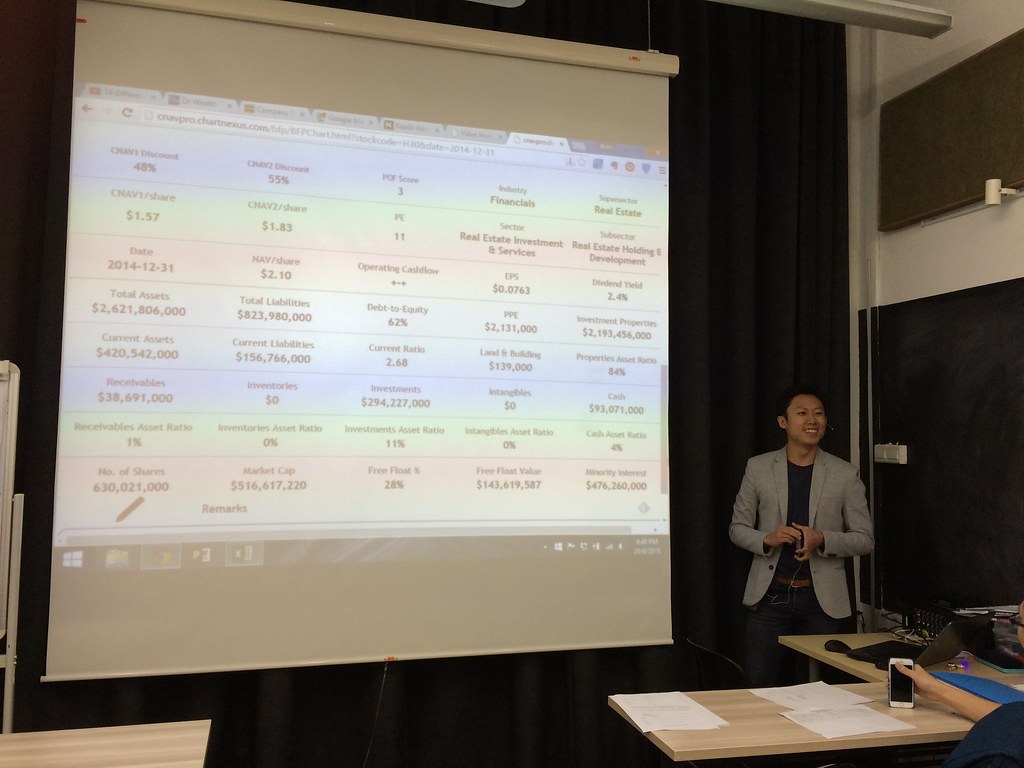

Thoughtfully designed for people who have full-time day jobs, this is a power-packed one-day course which teaches you a method to screen stocks using a scientific Conservative Net Asset Value (CNAV) method.

The method applies three filters to take the guesswork out of the stock-screening process.

- CNAV1. While NAV = total assets minus total liabilities, CNAV1 = good assets minus total liabilities. More applicable to property-related stocks.

- Profitability, Operational efficiency and Financial stability (POF) score.

- CNAV2. CNAV2 = good assets + 50% x Income Generating Assets minus total liabilities. Applicable to all stocks.

Students were kept busy with calculations (bring a calculator!), a game involving real money (bring a $10 note!) and learning how to evaluate financial statements (an invaluable skill in itself!).

The essence of the CNAV strategy was to use these three filters to evaluate whether the current stock price of a certain company is a good bargain, so you can safely invest in it with a huge margin of safety and profitability.

The key takeaways the CNAV strategy really appealed to me:

- Sieve out small companies doing unsexy businesses, but whose stock prices are currently undervalued (otherwise known as the Little Ugly Monster stocks).

- Don’t take profit too soon; Many investors tend to be overly excited when they start to see gains on their stocks and cannot wait to cash in on their gains. The CNAV strategy provides you with a target price to sell based on the Net Asset Value (NAV) of the stock. This takes the guesswork and the emotions out of your decision.

- Many of the stocks have a profit target of more than 100% on their purchase prices. This may take a while to materialise, hence it is suggested that an investor should start with at least five and work towards having 18 stocks in his or her portfolio.

- After letting the numbers speak for themselves, do due diligence on the management of the company. If top brass are also shareholders, they have more vested interests in the growth of the company and won’t let stock price plummet.

Alvin Chow started bigfatpurse.com as a blog in 2007 to document his journey in the financial markets. Being retail investors and non finance professionals themselves, the BFP guys know how to break down facts and figures into layman, bite-sized nuggets of information even I, a mathematical idiot, can digest.

After attending this course, it basically means that I can pore over a company’s financial statement, and make a rational evaluation as to its investment value – a skill I value at higher than $98, which is the course fee. But the thing is, there are 800 stocks in Singapore, with 400 of them are priced below NAV – am I going to sift through all of them in order to handpick five for my portfolio?

The good people at BigFatPurse have it all thought out. They have created a database of all the stocks in the Singapore market which you can purchase via a monthly subscription. For the busy investor looking to build a portfolio of undervalued stocks, the database is invaluable!

If you’re still relying on tips and IPO releases to help you find the next good stock to invest in, don’t. Attend this course now and you’ll see that your $98 is a worthy investment itself.

Details:

Value Investing Mastery Course

Fee: S$98

When: They hold a class every month, next one is coming up on July 19.

Timing: 9 am to 6.30 pm

Where: MacDonald House (A three-minute walk from Dhoby Ghaut MRT station)

Website: http://www.bigfatpurse.com/vimc [Alvinology readers get a 10% discount when you use the discount code: ‘ALVIN’ during the checkout]