Earlier in May, NTUC Income, Singapore’s largest motor insurer, launched Orange Eye, a first of its kind mobile app, aimed to encourage drivers to submit video footage in the event of an accident.

I know what you are thinking…

No, it’s not for the purpose of STOMPing or gossiping, but to combat insurance fraud, tackle road bullies and to make the roads safer for everyone.

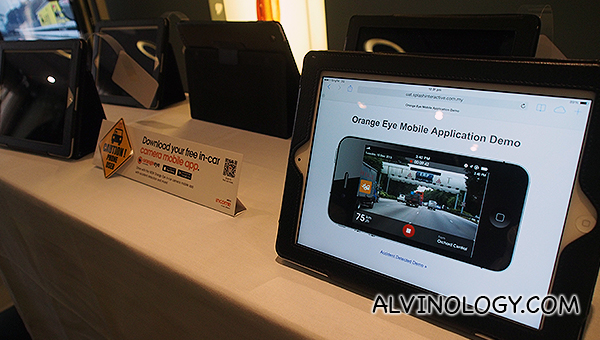

The app, available for free on both iPhone and Android platforms, comprises a recording device which captures footage of the road and enables drivers to conveniently submit their videos as evidence when making motor insurance claims. For NTUC Income motor policyholders, Orange Eye comes with the additional option to notify Orange Force, its 24/7 accident response team.

I like it. Simple proposition, straight-forward app, offering a useful service.

In-car camera: A growing trend

The use of in-car cameras has grown significantly in recent years. NTUC Income shared that there has been a marked increase in policyholders submitting their claims together with the video evidence. Video evidence can be useful in reducing discrepancies of statements between parties. It can also assist NTUC Income in protecting the interests of its customers if fraudulent activity is suspected.

More than just an in-car camera

Besides a recording device, Orange Eye has an Accident Toolkit that helps drivers make informed decisions in accident situations. This includes an “instant call” button to activate NTUC Income’s Orange Force accident response team, a “message” button to send a pre- determined SMS together with map location to your chosen emergency contact, as well as other useful advice on what to do after an accident.

Orange Eye also alerts drivers to renew your road tax and insurance and allows you to share videos via social media.

“Most drivers recognise that video evidence is useful in settling disputes. However, some drivers prefer not to install in-car cameras to avoid additional clutter while others are not willing to pay for them. Orange Eye, which is free, transforms a mobile phone into a multi-functional device that integrates with the service provided by Orange Force. It underscores NTUC Income’s continual innovation for the benefit of our customers.” Said Marcus Chew, Vice President of Strategic Marketing, NTUC Income.

A move to combat insurance fraud

According to General Insurance Association of Singapore, an estimated 20 per cent of motor insurance claims are inflated or fraudulent. This costs the motor insurance industry approximately $140 million each year.

“If fraudulent practices persist, motor insurance premiums will inevitably increase. This affects everyone, including safe drivers who do not make any claims. Orange Eye has the potential to curb rising motor insurance premiums.” Said Peh Chee Keong, Vice President, Motor Insurance, NTUC Income.

I agree with him. As a driver myself, I am pissed that I have to pay higher premiums because of a few black sheep. Most of us buy motor insurances because it is required by law and seldom even make claims.

In recent years, NTUC Income has increased its efforts to combat fraudulent claims. Using comprehensive data analytics to identify pre-determined “red flags”, the insurer has referred more than 150 suspicious cases to the authorities for further investigation in the last five years. Investigations of more than 50 cases have been completed, of which about one-third were brought to court and warnings issued in six other cases.

S$100 discount to encourage video submissions

To encourage the use of Orange Eye, NTUC Income will offer its motor policyholders1 a S$100 discount on their insurance premiums when they submit useful video evidence that helps settle a claim, regardless of which party is liable. The same offer is also extended to non-policyholders if they choose to be insured with NTUC Income upon renewal of their motor insurance policy. Even those who are not involved in the accident can enjoy the discount if they have useful video evidence that helps settle a claim made after an accident, provided they are policyholders or become policyholders.

“In most cases, motorists submit video evidence to prove that they were not at fault. We would like to encourage our policyholders to submit evidence even when they are at fault or when they are unsure about their culpability. That will help us settle claims, especially third-party claims, fairly and more promptly.” Added Peh.

A customer-centric innovation

Orange Eye is the latest customer-centric, game-changing initiative implemented by NTUC Income. In 2011, NTUC Income launched Orange Force to provide accident-scene assistance to our customers as well as to protect their interests.

“With the increasing popularity of in-car cameras, NTUC Income’s Orange Eye is an innovative solution that makes a recording device immediately available. With more ‘eyes’ on the road, drivers are likely to be more conscious about their driving behaviour.” Ended Chew.

![[PROMO CODE INSIDE] Check out Frasers Property Retail’s exclusive savings and rewards via GrabFood! [PROMO CODE INSIDE] Check out Frasers Property Retail’s exclusive savings and rewards via GrabFood! - Alvinology](https://media.alvinology.com/uploads/2023/05/FRx_Grab_MM_bro-1024x741.jpg)